Shopify tax calculation

Ideally Id like to enter line-items and customer address. 1 Is it correct that there is no way to use the Shopify API to calculate sales tax.

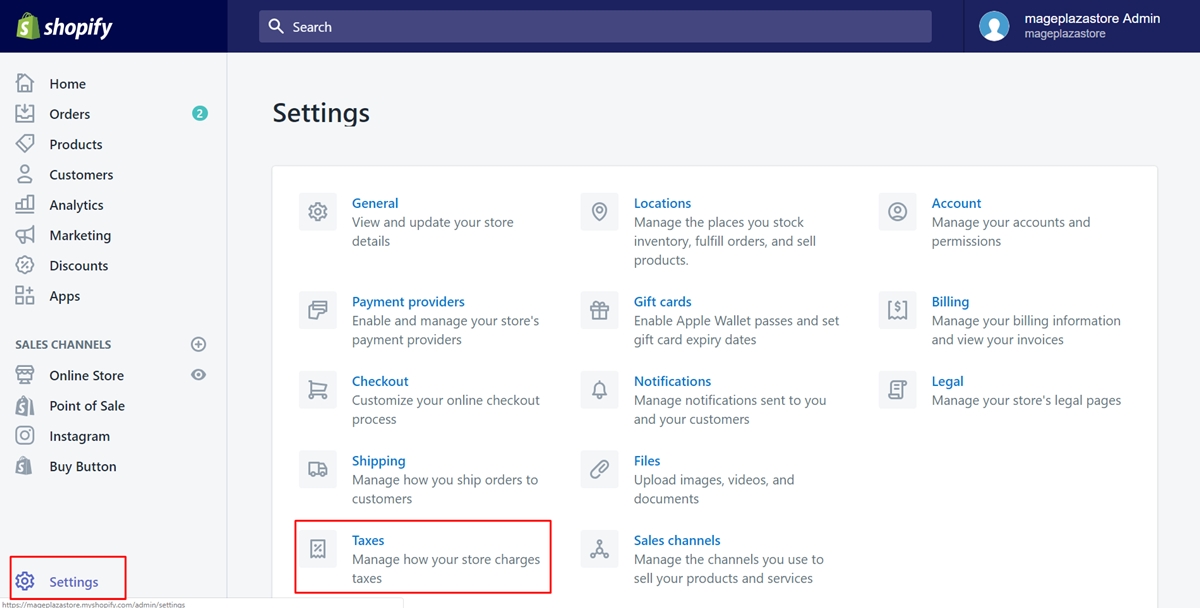

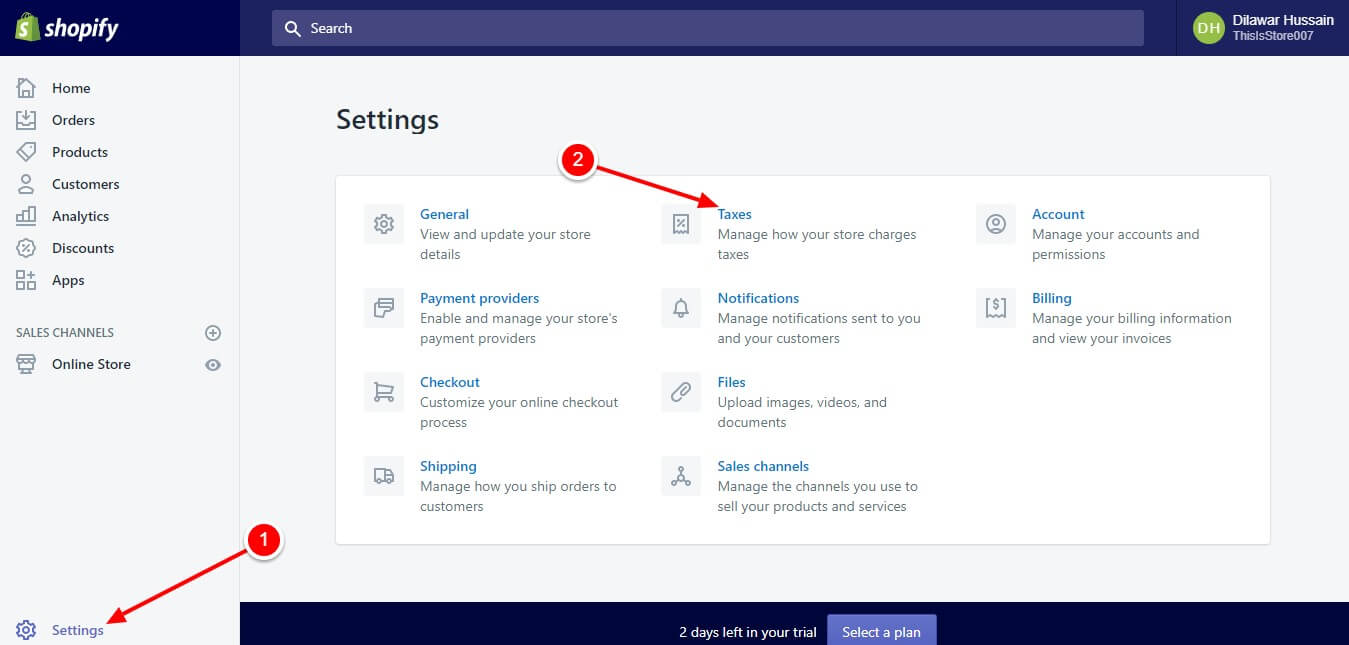

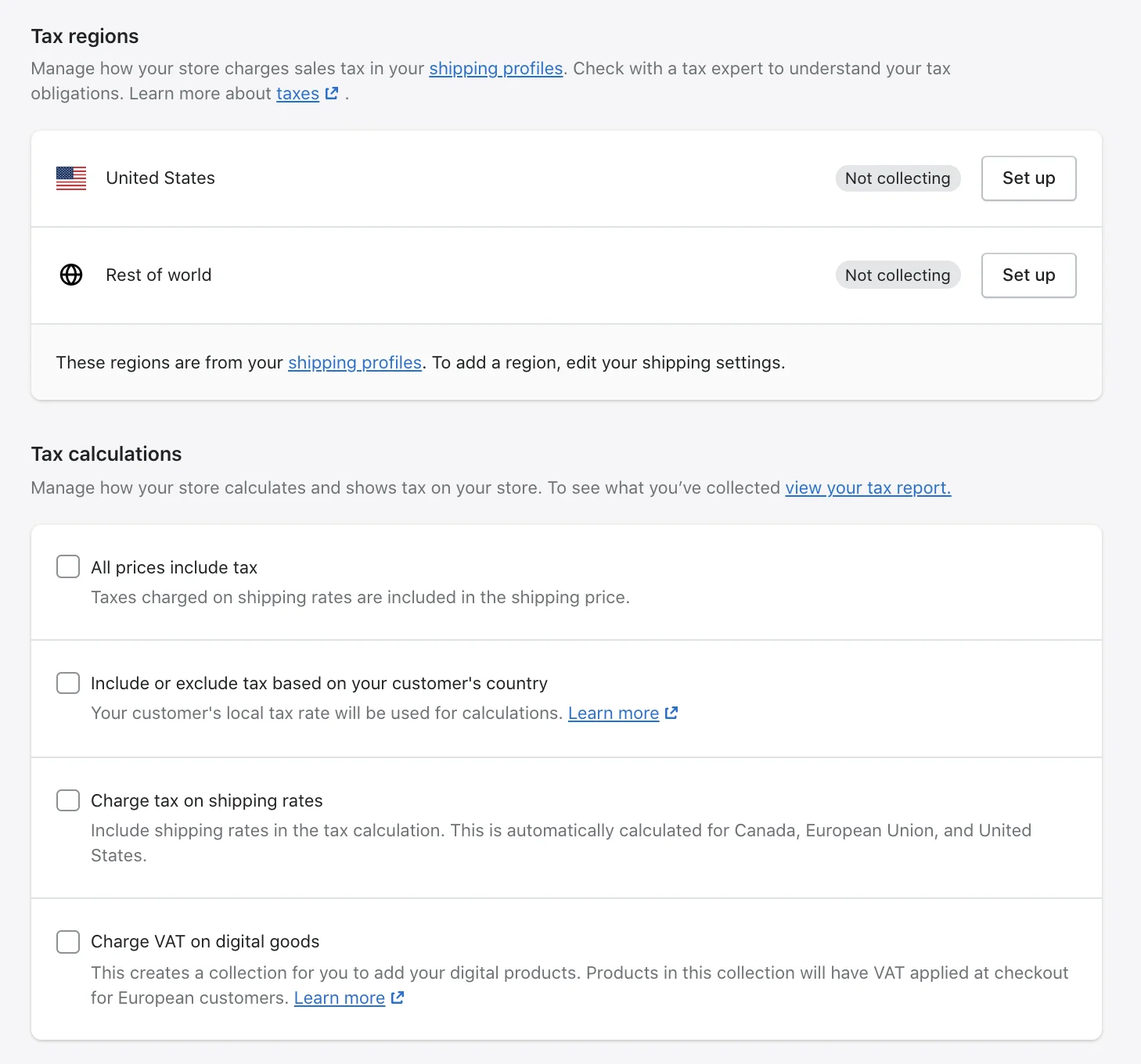

How To Set Up Automatic Tax Rates On Shopify

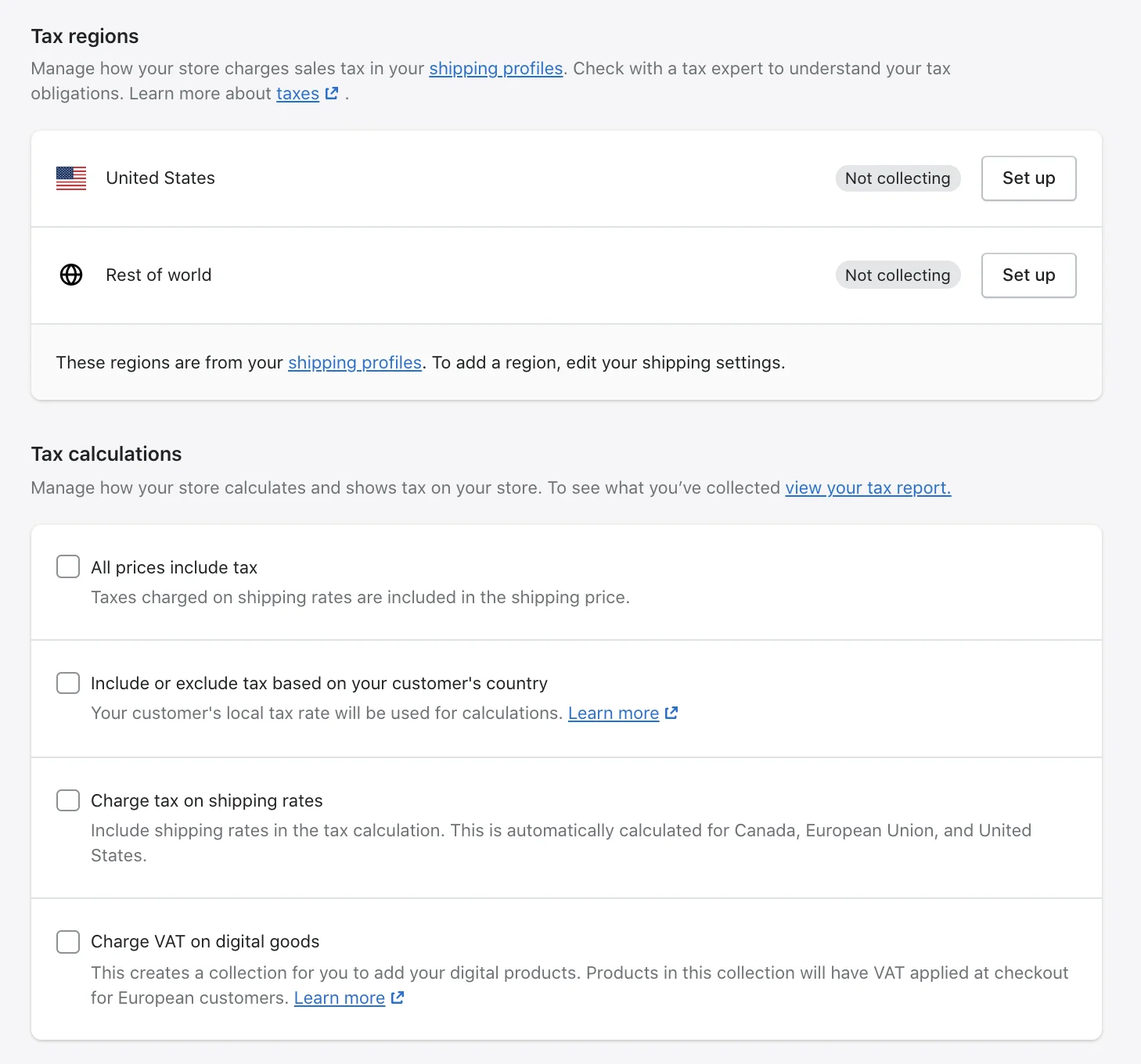

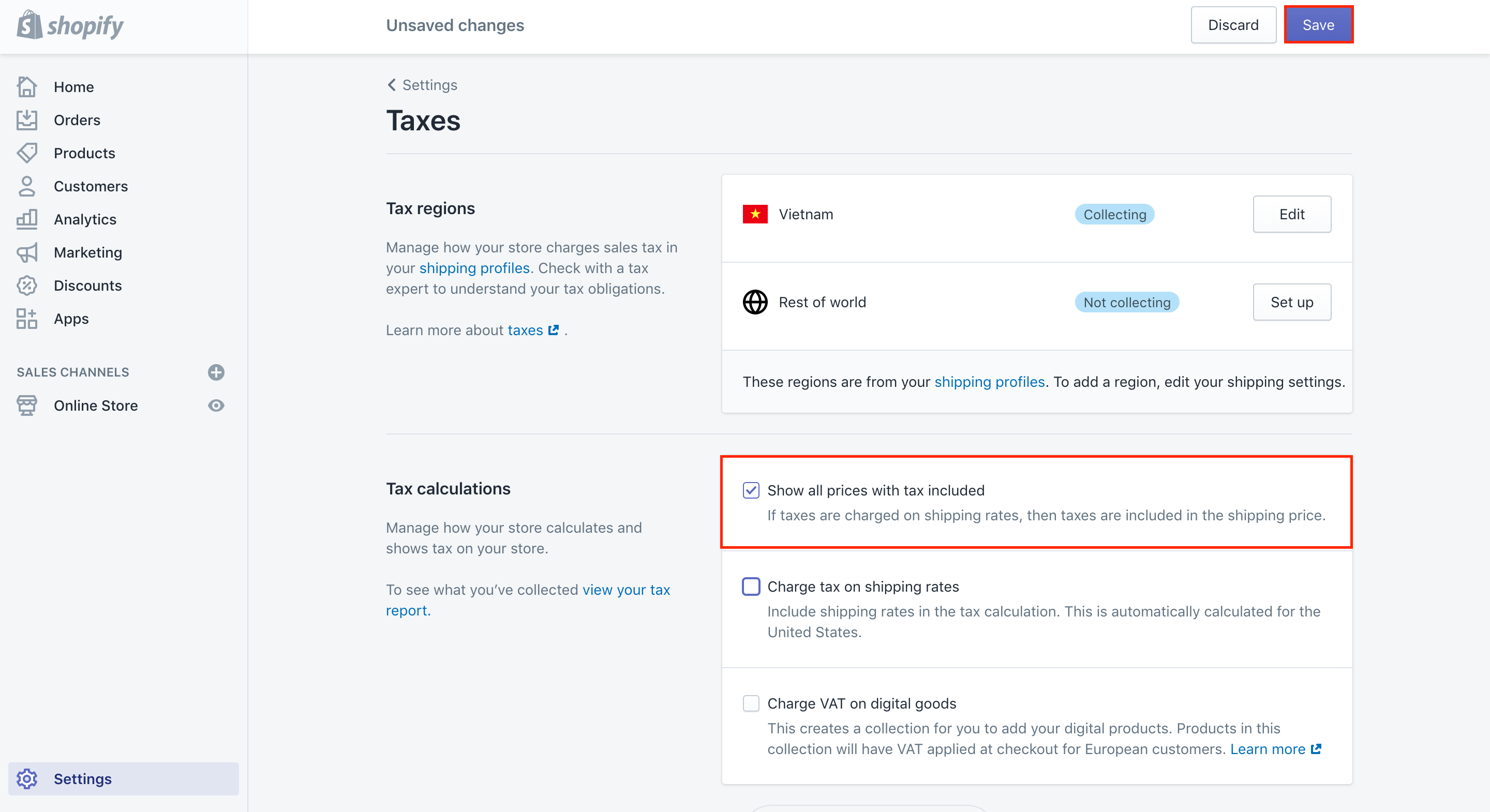

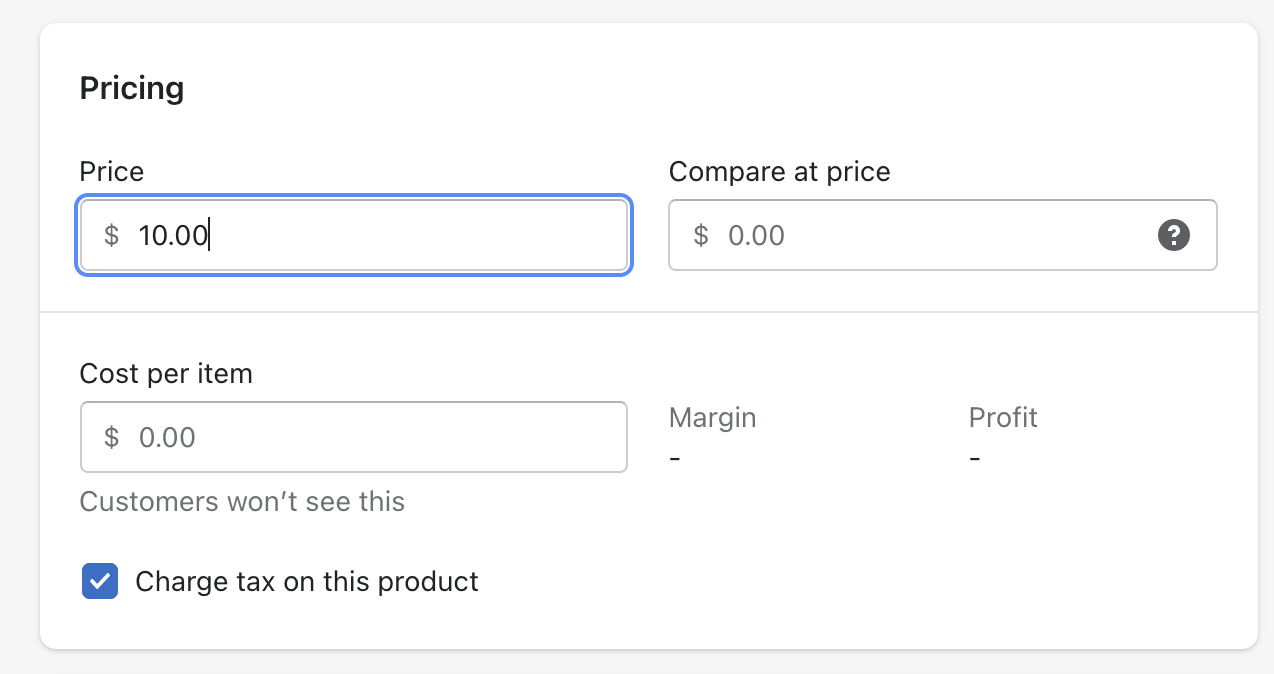

Separate Sales Tax Include your sales tax separately from the price of the item.

. Lets plan your success. For this we would like to calculate taxes. Shopify comes out-of-the-box with tax rates for different regions.

Ad Maximize your potential and grow your business with unlimited capital aligned to your plan. Keep more profit while reducing risk and stress. Our Premium Calculator Includes.

Our Premium Calculator Includes. - Compare Cities cost of living across 9 different categories - Personal salary calculations can optionally include Home ownership or rental Child care and. These charges are billed by the external provider and wont appear on your Shopify invoice.

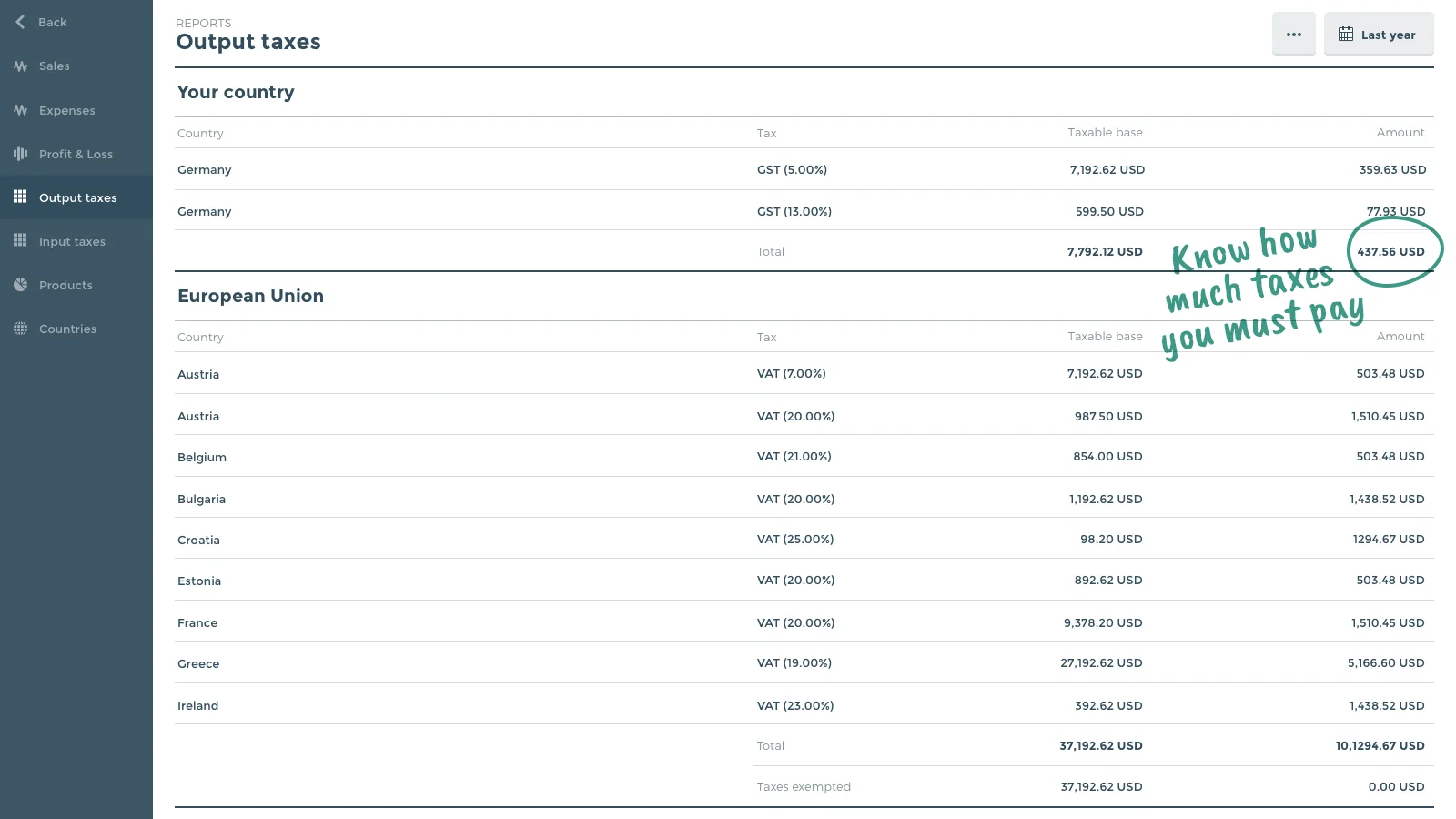

Quaderno automatically calculates the correct tax rate on every transaction based on the data provided by Shopify and issues a receipt for. Heres a sample sales tax permit application from the state of Florida. Shopify uses default sales tax rates from around the world and theyre updated regularly.

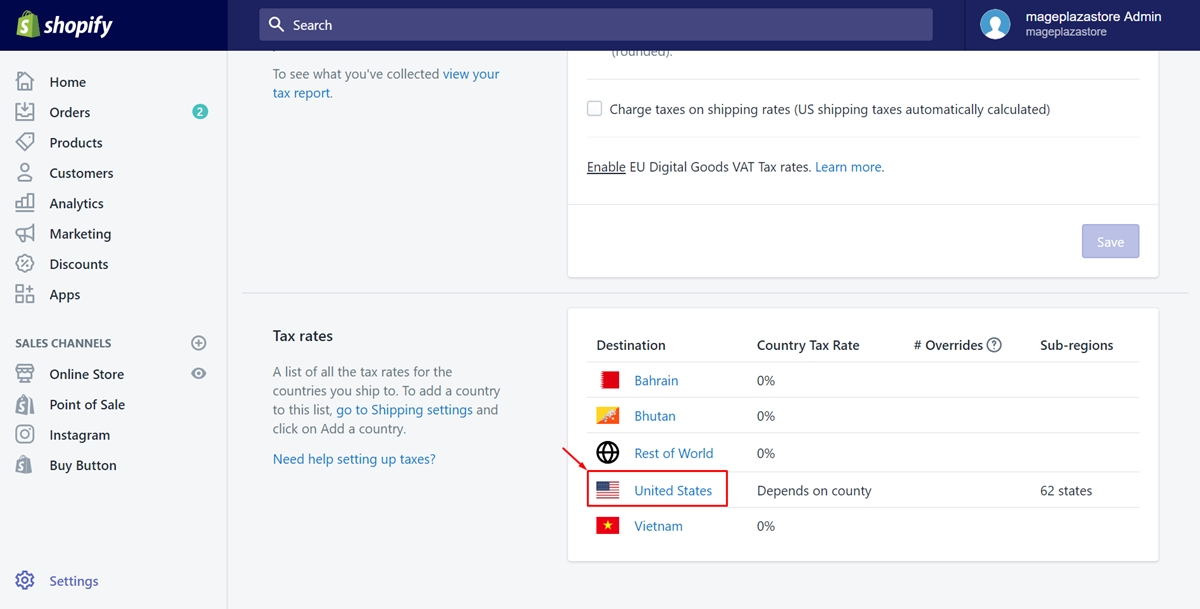

Here are a few key recommendations when it comes to setting up sales tax in Shopify. Ad Maximize your potential and grow your business with unlimited capital aligned to your plan. Set up your taxes in Shopify After youve determined where you need to charge tax in the United States you can set your Shopify store to automatically manage the tax rates used to calculate.

20month 19 transaction fee for international orders. Learn Why Financial Services Companies are Making Changes to Their Tax Operating Model. Lets plan your success.

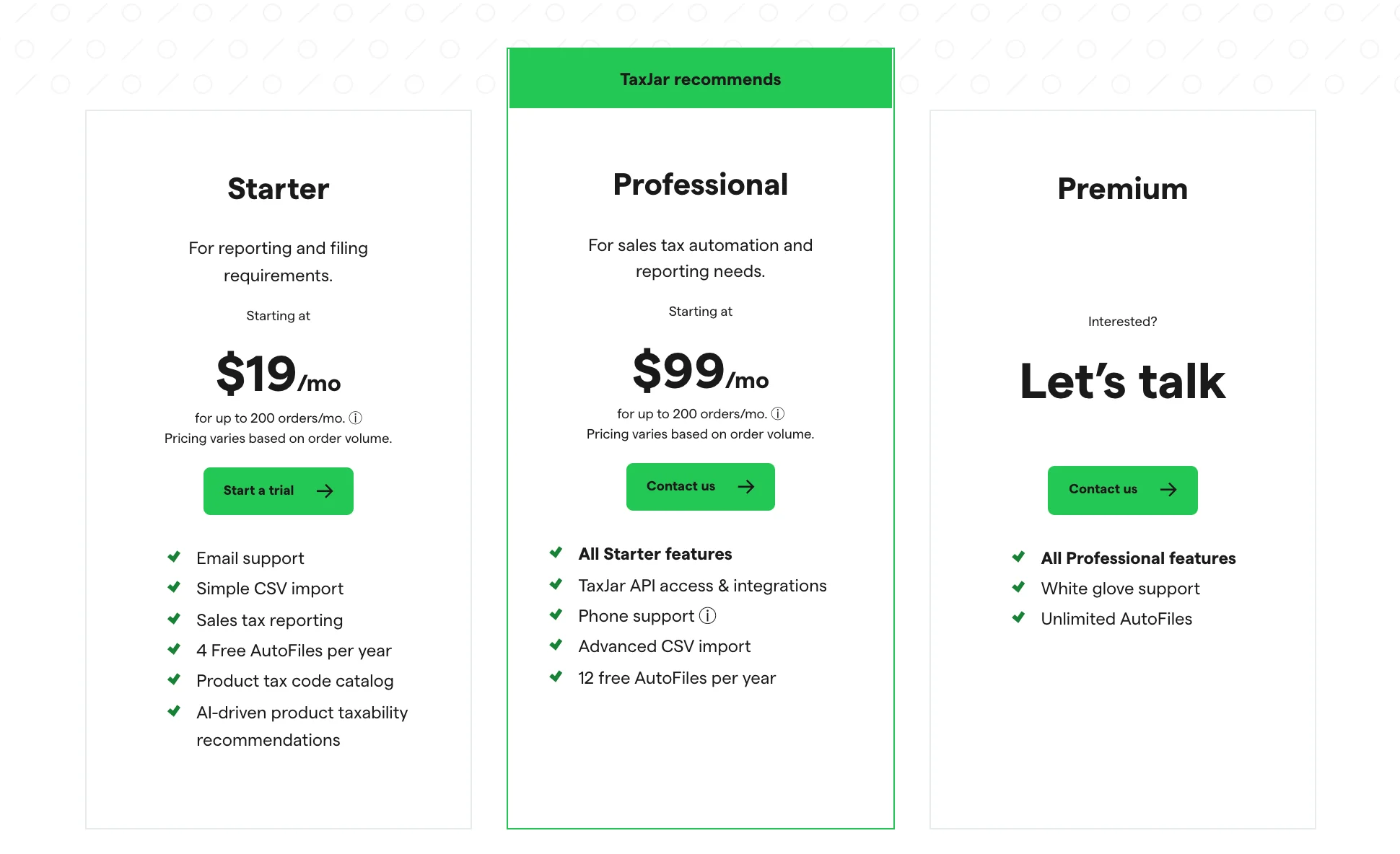

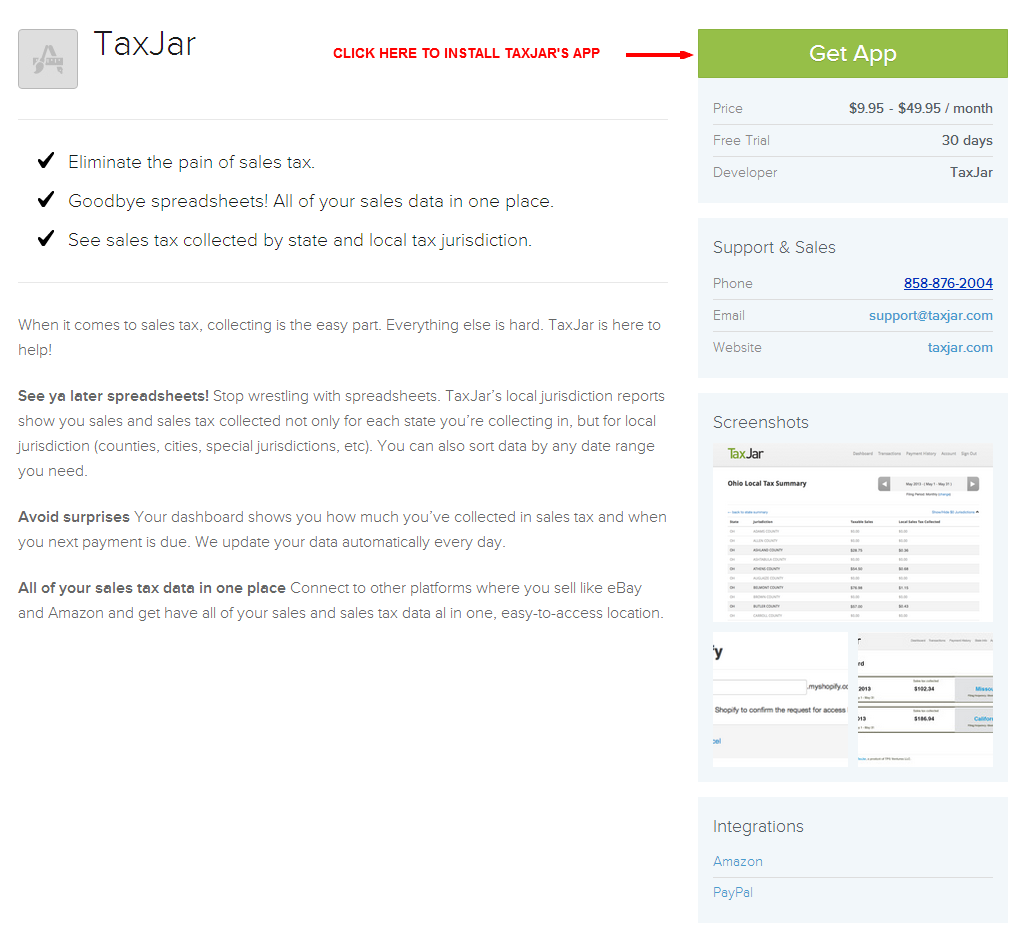

Calculate the correct tax rate on every transaction. As a Shopify business owner we help you automatically handle most tax calculations. Initial setup fee starts at 1000.

A customer in Rohnert Park CA Sonoma county was taxed 725 for state and 0875 for county but not the 050 Rohnert Park City tax. Keep more profit while reducing risk and stress. The Sales Tax charged should.

Once youre registered in the states where you have nexus its time to set. - Compare Cities cost of living across 9 different categories - Personal salary calculations can optionally include Home ownership or rental Child care and. These will depend on the shipping zones you set up for your store and on the location of your business.

Ad Leading Class Tax Tools and Technology to Help Businesses Stay Competitive. Set up sales tax collection.

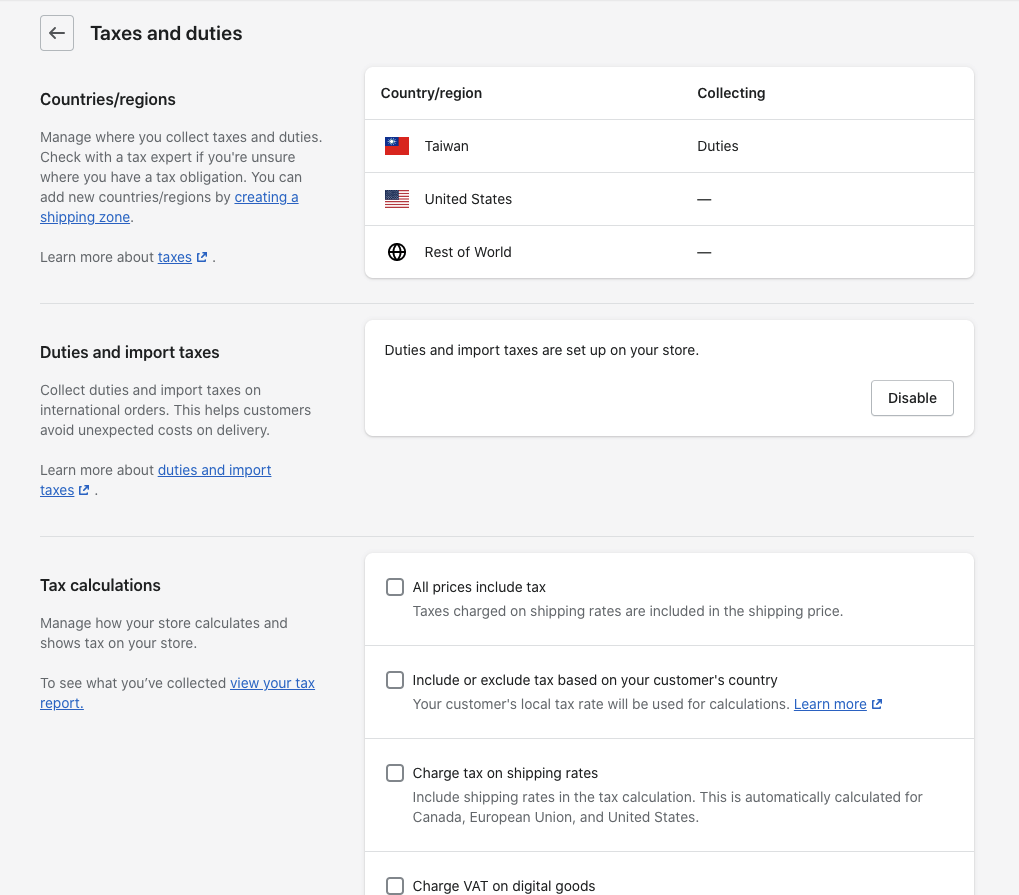

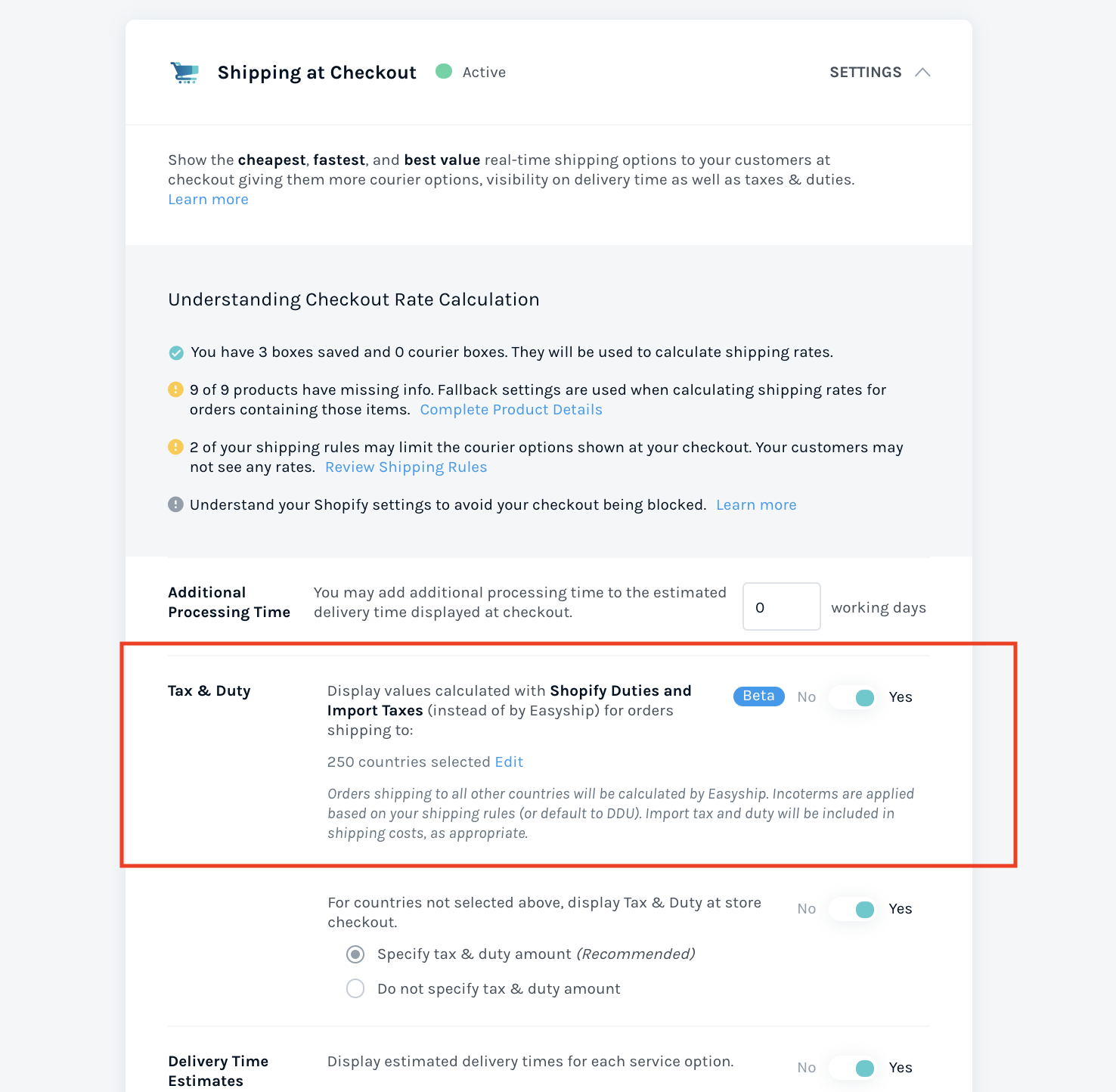

Shopify Duties And Taxes Support Shopify Markets Easyship Support

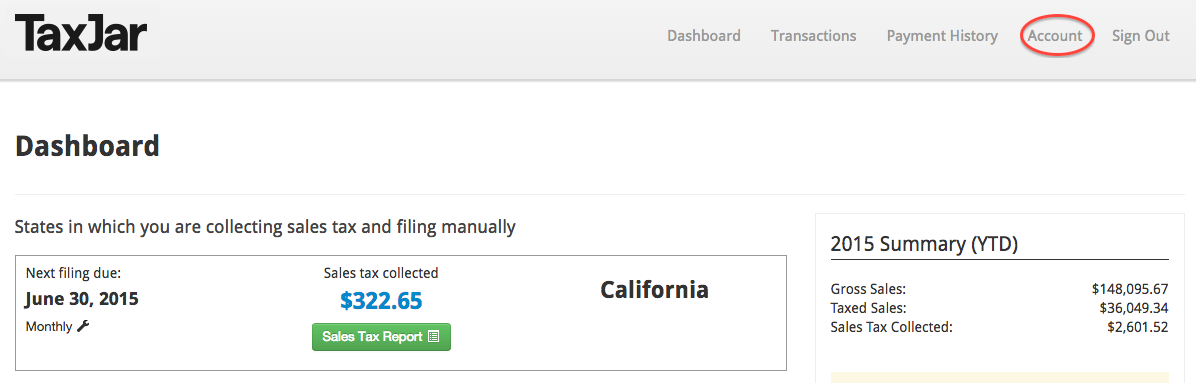

Sales Tax Guide For Shopify Sellers Taxjar Developers

How To Charge Shopify Sales Tax On Your Store Aug 2022

How To Charge Shopify Sales Tax On Your Store Aug 2022

Shopify Calculating California Sales Tax Incorrectly Shopify Community

Shopify Duties And Taxes Support Shopify Markets Easyship Support

Sales Tax Liability 5 Things To Know For Your Shopify Store Taxjar

Sales Tax Guide For Shopify Sellers Taxjar Developers

How To Set Up Automatic Tax Rates On Shopify

Shopify Apps For Taxes Simple Guide To Taxes On Shopify

Sales Tax Guide For Shopify Sellers Taxjar Developers

What Is The Formula For Tax Calculation On Shopify Orders Shopify Community

Shopify Calculating California Sales Tax Incorrectly Shopify Community

How To Charge Taxes On Shopify Store

Configuring Tax Settings With The Shopify Checkout Integration Recharge

How To Charge Shopify Sales Tax On Your Store Aug 2022

How To Charge Shopify Sales Tax On Your Store Aug 2022